The U.S. Treasury Department hasn’t issued final regulations implementing the 2018 Foreign Investment Risk Review Modernization Act (FIRRMA), but space industry entrepreneurs already feel the law’s effect.

The U.S. Treasury Department hasn’t issued final regulations implementing the 2018 Foreign Investment Risk Review Modernization Act (FIRRMA), but space industry entrepreneurs already feel the law’s effect.

“It hurts,” Mike Collett, founder and managing partner of Promus Ventures, a venture capital firm based in Chicago, said at the World Satellite Business Week conference in September. “I understand, as a U.S. citizen, what the administration is trying to do. But this is having a very negative effect on funding rounds.”

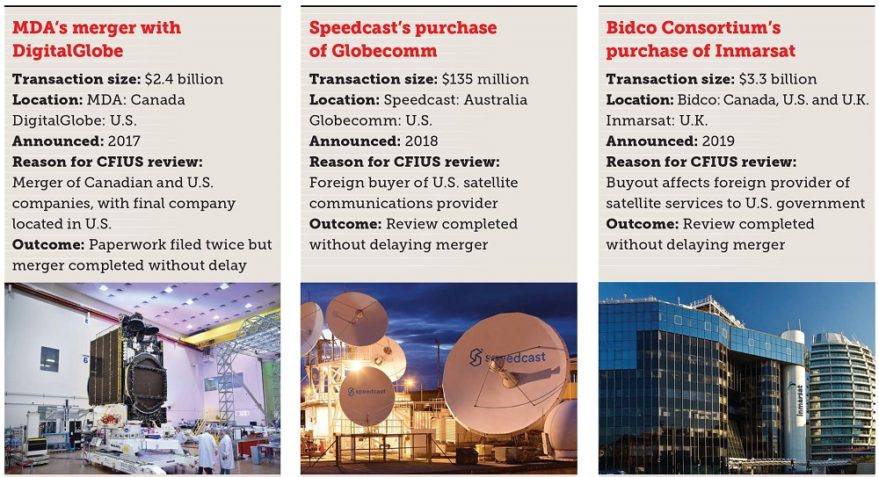

The Foreign Investment Risk Review Modernization Act expanded the role of the Committee on Foreign Investment in the United States (CFIUS), an interagency panel led by the treasury secretary to examine investments with potential impacts on national security. Prior to 2018, CFIUS (pronounced SIFFee-yus) primarily reviewed mergers, acquisitions and investments that gave foreign persons or entities at least a 10% stake in U.S. companies. Under the new law, CFIUS can review any investment in critical infrastructure and critical technologies if an investor obtains certain rights, such as a seat on a company’s board of directors or access to technical information that is not publicly available.

FIRRMA does not single out investment from specific countries. However, the legislation is designed to encourage added scrutiny of certain investments, including Chinese investments, and to create a more efficient process for clearing investments from U.S. allies that do not raise national security concerns, said Brian Curran, a Hogan Lovells partner, who previously worked as a Defense Intelligence Agency analyst.

On Sept. 24, the Treasury Department published proposed rules in the Federal Register and requested comment for a plan to exempt certain foreign investors from the CFIUS review process. Under the plan, the Treasury Department would publish a list of foreign states that conduct their own robust review of foreign investment. Investors with ties to those states could then apply for exemption from CFIUS review for certain transactions.

“As this is a new concept with potentially significant implications for the national security of the United States, CFIUS initially intends to designate a limited number of eligible foreign states,” according to the Treasury Department’s Federal Register notice.

For now, FIRRMA is makes it more difficult for space companies to accept money from any private foreign investors, said Mikhail Kokorich, an entrepreneur who established consumer businesses in Russia prior to founding space companies in the United States, Canada and Europe. “The main victims are small and medium-sized companies that create new technologies and depend on investor money,” he added.

Investors and entrepreneurs largely echo that sentiment.

“CFIUS is designed to have an impact and it is having an impact,” Mark Boggett, CEO, co-founder and managing partner of Seraphim Capital, a space-focused venture firm based in London, said at the World Satellite Business Week conference in Paris. “It’s creating an additional hurdle that we have to get over in order to invest in the U.S. market. Hurdles obviously aren’t good.”

RETURNING MILLIONS

Space entrepreneurs focused on commercial markets say they are frustrated by the changing rules. Startups seeking U.S. government contracts largely steer clear of CFIUS review by avoiding foreign investment altogether or strictly limiting investment to U.S. citizens and close U.S. allies.

One commercial space entrepreneur is considering returning millions of dollars of foreign investment.

“CFIUS is a big deal,” said another entrepreneur, who is trying to raise money but recently turned down funding to avoid CFIUS review.

“Space companies require a lot of capital,” said a third entrepreneur, who asked not to be quoted by name. “CFIUS makes raising money even harder.”

Investment funds have sprung up in recent years to back space industry startups but some of those, like the Seraphim Space Fund, are not based in the United States. In addition, funds established by U.S. venture capital firms sometimes involve limited partners from around the world, which could trigger CFIUS review.

TIME AND MONEY

Entrepreneurs are not simply declining foreign investment because they think CFIUS will not approve of specific transactions. They want to avoid the entire review process, which they say is time-consuming and expensive.

After FIRRMA was passed in 2018, the Treasury Department created a pilot program to test rules for 27 critical technologies including space vehicle manufacturing and space vehicle propulsion. Under the pilot program, which remains in force, companies working with these critical technologies are required to submit proposed investments for CFIUS review. They face penalties if they fail to comply.

In an attempt to ease the reporting burden, companies can submit an abbreviated form that is about five pages long to notify CFIUS of transactions 45 days before they are scheduled to close rather than providing more extensive documentation.

“But CFIUS is not required to make a final decision on a [short-form] declaration in that time frame,” said Francesca Guerrero, an international trade attorney in the Washington office of Winston & Strawn. “If you want to get a final decision, you need to do a full notice. You should give yourself at least three or four months for a complete filing.”

Private equity investors and venture capitalists tend to make decisions and close funding rounds far more quickly. As a result, the prospect of CFIUS review is prompting people to “back off from deals as opposed to doing a filing,” Guerrero said.

A small company can spend hundreds of thousands of dollars hiring legal experts to prepare CFIUS documents, an entrepreneur said.

“If you have a $1 million investment injection into a small startup in one of these critical technologies, a substantial amount is going into legal fees,” said Antonia Tzinova, an international trade specialist and partner in the Washington office of Holland & Knight. “It doesn’t justify proceeding with the investment.”

Some companies are structuring new investments to avoid CFIUS review by preventing foreign investors from acquiring board seats and other rights. “There’s been a real focus on staying out of CFIUS review,” Guerrero said.

That may change if the CFIUS review process speeds up. Prior to FIRRMA, CFIUS had 30 days to complete an initial review of transactions and decide whether to conduct a more thorough investigation. Since FIRRMA called for mandatory review of investments in critical technologies, critical infrastructure and personal information, CFIUS has far more transactions to assess. Taking that into account, the new law provides the committee with 45 days, and the possibility of a 15-day extension, to decide whether to clear a transaction or launch an investigation.

Particularly for investments involving U.S. allies, “we are beginning to see more transactions clear in the initial 45-day review period,” Curran said. “I think CFIUS is focused on trying to get cases cleared in that initial 45-day period, while meeting its mandate of safeguarding national security.”

SHIFTING RULES

Entrepreneurs balk at the uncertainty created by the lengthy regulatory process. The Treasury Departments is continuing to draft regulations implementing FIRRMA and to review public comments in response to rules proposed.

Meanwhile, the Commerce Department is creating a list of emerging and foundational technologies that will be subject to export controls and subject to mandatory CFIUS review because they will be considered critical technologies. Additive manufacturing, machine learning and nanotechnology are broad categories of emerging technologies cited in an Advanced Notice of Public Rulemaking published in November 2018. The Commerce Department wants help determining whether specific technologies within those categories are essential to national security, according to a notice in the Federal Register.

“It’s normal to have a period of uncertainty,” said Anne Salladin, a partner in the Washington office of Hogan Lovells, who previously served as senior counsel for the U.S. Treasury Department. “There will a period of a couple of years where we will just have to see how things are interpreted by the committee.”

In terms of critical infrastructure, Salladin noted that CFIUS offered greater clarity in regulations proposed in September by defining which U.S. businesses involved with satellites will be covered. Investments covered by CFIUS involve owners or operators of satellites or satellite systems that provide services directly to the Defense Department or its components, according to the appendix to the proposed rules.

KNOW YOUR TECHNOLOGY

For space companies, the first step in complying with the new legislation is knowing whether any level of foreign investment would be subject to mandatory CFIUS review, Curran said.

For critical technologies that are part of the FIRRMA pilot program, “you need to know the export control classification of your products, software and hardware,” Salladin said. “Many companies haven’t done that analysis on a regular basis.”

Closely tracking export classifications can be challenging for small startups whose leaders tend to focus more on developing products and services, Curran added.

Entrepreneurs who paid little attention to CFIUS before FIRRMA, say they now consider CFIUS and U.S. export rules when establishing new companies. They weigh the pros and cons of various legal and regulatory regimes as well as the availability of skilled labor.

“I think it is probably good news to Europe,” Boggett said.

This article originally appeared in the Oct. 7, 2019 issue of SpaceNews magazine.

#Space | https://sciencespies.com/space/the-torture-of-cfius-a-2018-law-is-changing-the-way-space-industry-startups-raise-money/

No comments:

Post a Comment