Since Jan. 1, Maxar Technologies has revamped operations, installed new leadership and incorporated in the United States. Now, the company is exploring the intersections of its legacy business units as it looks for ways to expand its government and commercial product lines.

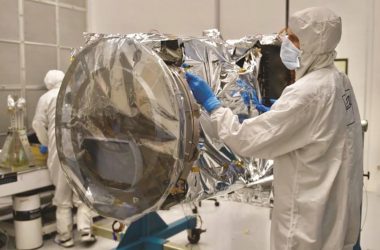

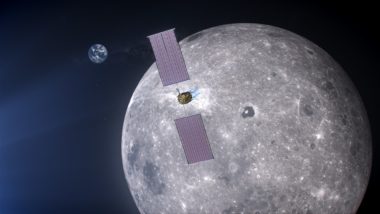

In the government arena, Maxar is drawing on satellite manufacturing expertise honed at SSL to build spacecraft for NASA, fly hosted payloads, attract new commercial customers and potentially sell satellites to the U.S. Defense Department. NASA selected Maxar in May to develop the Power and Propulsion Element for the lunar Gateway. In July, NASA announced plans to send its Tropospheric Emissions: Monitoring Pollution (TEMPO) sensor into orbit on a Maxar-built communications satellite.

Maxar is combining the Earth observation and analytics capabilities of DigitalGlobe, MDA and Radiant Solutions as it prepares to begin launching its next-generation WorldView Legion constellation in 2021. Satellite imagery also is at the heart of Maxar’s work with automobile manufacturers and ridesharing companies seeking to pave the way for autonomous vehicles.

Tony Frazier, the former president of Radiant Solutions, became Maxar’s executive vice president for global field operations in April. There, he leads Maxar’s sales, business development campaigns and oversees services outside of Canada, where MDA remains a vertically integrated company. Frazier discussed Maxar’s government and commercial business ventures with SpaceNews earlier this month at the World Satellite Business Week conference in Paris.

Is the U.S. government business important to Maxar?

We are now in a position to fully realize the strategy of the U.S. Access Plan that MDA had, bringing together the legacy operations of DigitalGlobe, Radiant and SSL. They each were working with the U.S. government in different capacities They each had an intense focus on growing the U.S. government business.

The legacy SSL business seemed very focused on commercial communications satellites.

That certainly was its primary focus but it had an aspiration of growing the U.S. government business through relationships with NASA. Obviously, the headline award for us this year was the Power Propulsion Element award followed by TEMPO. The business also aspired to grow in national security space. By integrating the teams, we’ve gotten more focused on those opportunities. If we have a relationship through our imagery business with a national security agency, we are able to socialize the end-to-end solution.

One of your relationships is with the National Reconnaissance Office. Maxar, Planet and BlackSky won NRO study contracts in June.

That was part of [NRO’s] effort to understand what’s possible with commercial providers. The intent of that is to forecast, based on what investments we’ve already made and what investments we could make in new assets, how much more mission the intelligence community could push to commercial providers.

In addition to electro-optical satellites from DigitalGlobe, Maxar has radar satellites thanks to MDA.

Yes. We’re doing some amazing things exploiting Radarsat-2 for customers across vertical markets. We have ground terminals that are able to downlink both optical and radar data within minutes to allow a number of really exciting maritime domain awareness use cases. We’re using Radarsat-2 to do broad-area search for vessels and then characterize those with optical.

There’s a lot of talk about solutions that combine optical, radar, radio frequency and other types of data. Is that where the Earth observation business is moving?

Absolutely. It is moving toward multimodal and also toward more real-time exploitation of the data. We’re moving toward a world where you’re able to see anywhere on the ground any time, across sensors. But it’s also creating a requirement to exploit that data more quickly. We have a focus on application of artificial intelligence machine learning to extract information from remotely sensed data, but to also discover anomalies in the data. Those are all part of the same thesis, which is, “How do I anticipate threats in time to make a difference? How do I understand the changing planet?” There’s a collection element and an exploitation element. Doing it on a broad scale at rapid timelines is the common theme.

How important is the ground infrastructure to speedy data exploitation?

The ground is critical. We’ve made a heavy investment in our global network of ground terminals. We have contact between our satellites and a ground terminal to downlink data over 95% of the world’s landmass in near real-time, 20 minutes or less. That contributes to our ability to satisfy those timelines. A number of our customers supplement our ground infrastructure with their own systems. For example, we’re making good progress in building out regional coverage across Australia. The Australian Department of Defense made an $83 million investment. We were able to take them live early with our virtual solution. We have a solution called Rapid Access, where they get command and control access to the system to put in tasking requests. It’s all cloud enabled. They’re building out an infrastructure of ground terminals around the region. We are deeply integrated in their architecture just like we are with the U.S. government today.

Are you combining MDA and DigitalGlobe’s ground architecture capabilities?

DigitalGlobe and MDA had been longtime partners. Many of our Direct Access facilities were built leveraging MDA technology. The ground goes from receiving to image processing and making that data available for downstream exploitation. There were elements of that at MDA, legacy Radiant and DigitalGlobe. Part of Maxar’s Better Together initiative is getting a common architecture, from direct downlink for a tactical user to WorldView Legion constellation management. The teams are working together on that.

It seems like Maxar is broadening its focus in terms of satellite manufacturing at a good time since the geostationary communications satellite business has slowed in recent years.

We’re committed to the industry. What’s been exciting is that we knew we were making a big bet on our next-generation constellation in Legion. SSL was viewed as a strong provider. For me personally, it’s been interesting to see how that investment has become a catalyst to create a new spacecraft platform. It’s a modular architecture that can support remote sensing payloads but also geostationary communications payloads. That is something that we’re excited about.

Like the satellite you are building for Swedish broadband company Ovzon?

Yes. Being able to show the Legion platform can be applied not just to an optical low Earth orbit mission but to Ovzon-3, a geostationary communications satellite, is very exciting.

What about government geostationary communications satellites?

There are a number of initiatives that are in early stages of procurement, where we’re socializing the capabilities of the platform. We want to be disruptive. There’s a strong incumbent base there. And so the key is offering value that’s unique to the market.

Are there other U.S. government applications as well?

The core of our Earth intelligence business is supporting a number of these critical intelligence missions. The desire to increase persistence is strong across that community. We see that use case as one that we’ve been addressing in the imagery-as-a-service model and with our analytic capabilities. Having our own ability to build new types of assets that may supplement what we do as a service, assets that could augment national missions, is certainly something we see as very high potential. We’re spending a lot of time on that.

Is hiring a concern?

Talent is a big issue in our industry. We have over a hundred open billable positions. We know there’s higher growth we could command if we could bring in all the talent. For our government work, there’s the intersection of the right technical skills as well as [security] clearances. A lot of what we are doing with our customers is helping them understand that we can support a hybrid model where we have a part of the team that is cleared and maybe working on-site. Another part of the team is doing unclassified work.

We’re seeing effective results because the pace of innovation is changing so quickly in the commercial environment. We want to be able to integrate it into mission applications. We’re doing that with technology but also analytics.

How does that work?

Our Arlington, Virginia, office is a good example where we’re doing work completely unclassified but answering real intelligence questions. We are using commercial imagery and leveraging other open-source intelligence to apply a model that is similar to agile software development.

Would you ever build capacity exclusively for U.S. government customers, for example, image resolution you couldn’t sell to anyone else?

We have models for assured access now. If you look at our Direct Access business with our international defense customers, many of them pay a premium for access to the data and they don’t want that data in our commercial archive. We have a business model for that today. If the U.S. government was interested in that, we could explore that.

Mostly, we are pushing the envelope on temporal resolution. Because it’s tied to persistence, change detection, getting alerting around a trending event. Where you can do it across broad areas, that becomes very valuable.

Is Legion designed to provide that high temporal resolution?

It is. We are halfway through the build.

Maxar is working with General Motors, Toyota’s Research Institute, Uber and other ridesharing companies on mapping for autonomous vehicles. Why do they need satellite imagery?

With autonomy it’s important to have an authoritative reference. If you are trying to enable real-time navigation, you need to know not just that the road exists but the directionality, turn restrictions, lane markings. All that detail requires a 30-centimeter image or better. No one else has global coverage for 30-centimeter data. That is one of our discriminators.

We also are exploring how to accelerate automation to extract those features. A couple of weeks ago, we announced an initiative with SpaceNet, a road extraction challenge. We have imagery of multiple cities around the world. We have north of 100 participants competing to create a route-able road network in those cities. That gets us further down the path of not just having the right imagery for autonomy but also some of the right algorithms and tools to turn that into useful information.

I often see cars capturing 360-degree images for autonomous vehicles.

One of the challenges those companies have is they need to be able to tie down all that sensor data to a consistent reference layer. A number of these pilots have been exploring that data fusion.

Could autonomous vehicle mapping become a big business?

Absolutely. The next generation of mapping is going to enabled this. We have been building the foundation through collection of 30-centimeter imagery in the most densely populated urban areas. That’s part of our Metro product. We’ve been winning these pilots, with General Motors and Toyota, as examples. And we are pushing the envelope on artificial intelligence machine learning to start to create the information that then we can tie down. Those pieces come together around this use case.

This article originally appeared in the Sept. 23, 2019 issue of SpaceNews magazine.

#Space | https://sciencespies.com/space/maxar-weaving-components-into-new-business-ventures/

No comments:

Post a Comment