It is no longer a surprise to industry observers that partial reusability, economies of scale and vertical integration have enabled SpaceX to achieve extremely low Falcon 9 launch costs, nor is it a surprise that SpaceX’s launch and satellite connectivity businesses are inherently linked, as the company takes advantage of its industry-low launch costs to orbit its own broadband constellation for a fraction of the competition’s launch capital expenditure.

It may however remain a surprise to some that Starlink is also linked to SpaceX’s Smallsat Rideshare program, revealed August 2019, and that SpaceX will further reduce the Starlink launch capex by manifesting paying customers as rideshare payloads on some Starlink launches. In doing so, it may even break even or make a profit on such Starlink rideshare missions, on the condition that it identifies and contracts enough rideshare customers to offset the cost of a launch.

QUICK DIVE INTO COST NUMBERS

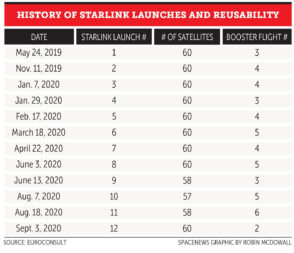

It is likely that SpaceX is capable of achieving an approximately $30 million launch cost after a single reuse, and that it is capable of much lower costs for Starlink with subsequent reflights, especially with previously-flown fairings. SpaceX has flown the same booster up to six times, as demonstrated with an Aug. 18 Starlink mission. In early 2020, SpaceX Director of Vehicle Integration Christopher Couluris, mentioned “[the rocket] costs $28 million to launch it, and that’s with everything” and that reuse is what “is bringing the cost down.”

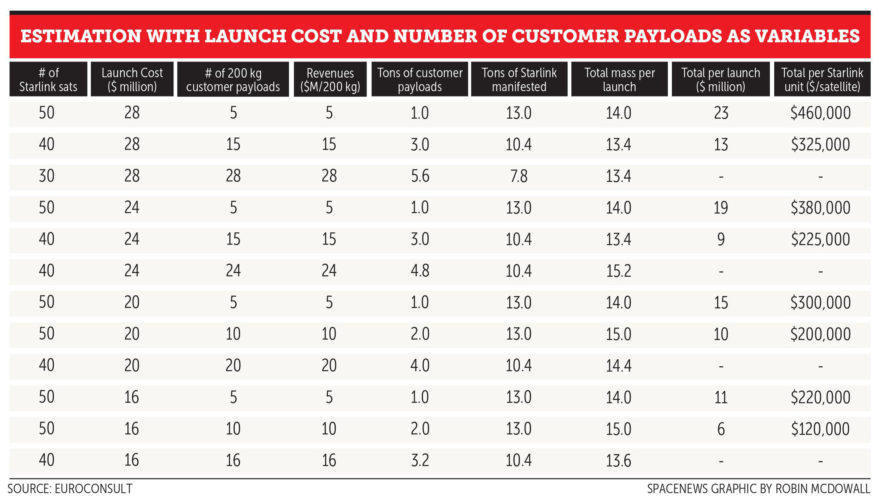

However, why would SpaceX show all their cards and offer lower launch prices as they already are the lowest bidder on the market in terms of specific price ($/kg) to all orbits? As the lowest bidder, SpaceX has no incentive to further reduce launch prices and it is only logical that it seeks to profit from this cost/margin advantage. Let us consider an average $25 million Starlink launch cost (a conservative assumption averaging new and reused booster costs even though SpaceX only uses reusable boosters for Starlink, and, from time to time, reused fairings).

Considering SpaceX’s Smallsat Ride share program pricing of $1 million per 200 kg of customer payload, a $25 million cost would require about 25 payloads of 200 kg (or 50 payloads at 100 kg) to reach break-even, i.e. five tons of customer payloads. Considering Falcon 9’s performance of 15.6 tons to low Earth orbit demonstrated on previous Starlink launches, this leaves about 10 tons of launch capacity for Starlink satellites (as well as payload adapters and dispensers for customers) to be launched at virtually no cost. SpaceX would adjust the number of Starlinks manifested on such a mission depending on “leftovers,” i.e. available mass and volume under fairing. At present, volume is likely to become a limiting factor, but that could change as SpaceX is developing a longer fairing for the U.S. Air Force.

A MODEL THAT ENTIRELY DEPENDS ON MARKET DEMAND TO INCLINED ORBITS

However, this model cannot be the baseline Starlink launch scenario because SpaceX cannot wait for paying customers to launch and still expect to meet regulatory deadlines by the International Telecommunication Union and the U.S. Federal Communications Commission for Starlink deployment.

The success of this model depends entirely on market demand for rideshare launches to Starlink injection orbits, defined by their 53-degree inclination and low altitude (roughly 200 km elliptical orbits which leave orbit-raising and circularization to the customer’s own propulsion system). SpaceX will not be able to fill up part of a Falcon 9 with paying customers every month, the launch rate it proposes on its Smallsat Rideshare website. Yet, this does not mean demand does not exist entirely, as several Earth observation constellations seek to launch inclined orbits to maximize their revisit rate over the most populated areas, which are the most lucrative and sought-after by the Earth observation market. This is the case of Planet, BlackSky, Maxar’s Worldview Legion, Satellogic, Capella and Iceye, among others, which are expected to launch at least part of their constellations to inclined LEO in the coming decade. Planet and BlackSky have both launched satellites on Starlink missions, suggesting a rapid market uptake.

While SpaceX may succeed in doing so from time to time, market demand and SpaceX’s own needs appear insufficient to enable monthly launches to a 53-degree inclination orbit with a sufficient number of customers to enable breakeven (approximately five tons of paying customers to offset a $25 million cost, six tons for a $30 million cost, and so on). It may however succeed in offsetting part of its costs with launch revenues, potentially launching 260-kg Starlinks at cubesat launch prices.

THE ROLE OF LAUNCH BROKERS AND PROPULSIVE DISPENSERS

The main limitation for market success would be the low number of customers interested in Starlink’s 53 degree inclination orbit, and the low perigee of the injection orbit which means a longer/ costlier orbit-raising phase for customers. This is where propulsive dispensers (or “kick stages” for last mile logistics) come in handy. Their main value proposition is to free satellites flying rideshare from the orbital parameters of the main payload. This gives customers flying rideshare with Starlink some level of freedom over the 53-degree inclination and low altitude, as well as enabling a faster time to orbit and preserving propellant compared to letting satellites orbit raise by themselves. This combination could be a real threat to micro-launchers.

Thus, it is only logical that launch brokers seem well aware of SpaceX’s plans, which presents less risk for brokers than procuring an entire Falcon 9 (SSO-A example). Rideshare provider Spaceflight clearly markets capacity on Starlink launches. Exolaunch, in its latest deal for rideshare capacity with SpaceX, recognized the distinction between a dedicated rideshare and a Starlink rideshare, as it favored non-Starlink rideshare launches. Momentus, which also booked capacity on several Falcon 9 rideshare missions, said it would fly “at least once on a Starlink mission” in the second half of 2021. On the pricing side, it is notable that SpaceX reduced its pricing from $2.25 million per 150 kg of payload to its current $1 million per 200 kg in August 2019, a few weeks after the announcement of its smallsat rideshare program. Could it be linked to the need to be the lowest cost launch solution available on the market in order to attract more paying customers, further reducing Starlink launch capex?

Finally, could SpaceX develop its own electric space tug or kick stage based on its Starlink Hall Effect Krypton thrusters and Tesla battery technology, without relying on third-party propulsive dispensers? This remains highly uncertain but could make sense as SpaceX’s taste for vertical integration is well known.

SO, CAN SPACEX ACHIEVE “FREE” STARLINK LAUNCHES?

In summary, while this scenario cannot be the base deployment plan for Starlink, it can and may further reduce Starlink launch costs for selected Starlink missions, possibly to the point of reaching breakeven or even making a profit in some extreme cases, depending on mission costs and market demand.

One final interesting thing to note is that as launch costs go down with the number of reuses of a first stage and fairing, the number of paying customers required to reach break-even also goes down. The less customer mass to be manifested on a Starlink rideshare mission to reach break-even, the more Starlinks can be manifested on a “free” launch. This seems to be a fair incentive for SpaceX to strive toward pushing the limits of reusability as far it possibly can.

Alexandre Najjar is a senior consultant at Euroconsult and editor of the “Prospects for the Small Satellite Market” research report, published in July.

This article originally appeared in the Sept. 14, 2020 issue of SpaceNews magazine.

#Space | https://sciencespies.com/space/op-ed-can-spacex-profit-on-certain-starlink-launches/

No comments:

Post a Comment